Revolutionizing Financial Access Across Burundi

Founded in 2022, PayVista is on a mission to bridge the financial inclusion gap between banked and unbanked Burundians.

Our Mission

Democratize digital financial services by providing mobile money in rural areas with access to capital, float financing , micro-loans and cutting-edge tools to serve financial services to people in places where bank and microfinance institutions ignore.

Our Vision

Create a Burundi where access to financial services is a right and all people have equal opportunity to thrive through accessible digital financial solutions.

Our Core Services

Agent Network

We build and train a robust network of mobile money agents equipped with advanced financial tools to serve thousands of people.

Smart Credit

AI-powered credit scoring enables micro-loans for Mobile money agents to scale their businesses with limited financial history.

Financial Insights

Real-time analytics help Agents track performance and make data-driven decisions.

Security

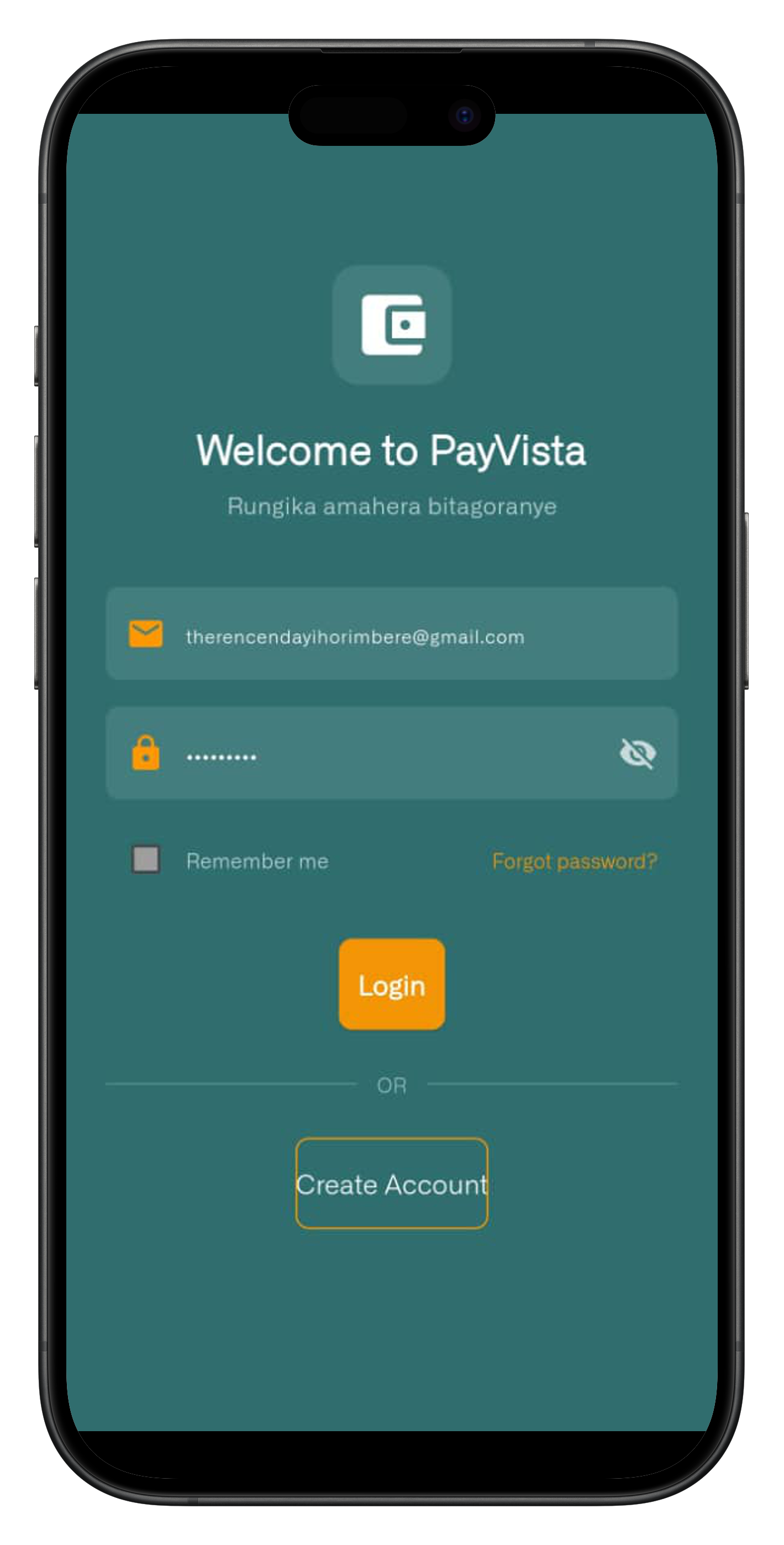

Enterprise-grade security protects all transactions and sensitive financial data.

Ready to be Champion Mobile Money Agent in Your community ?

Join our 600 and plus agents already growing with PayVista

Get Started NowWHO ARE WE?

PayVista builds and operates the last-mile infrastructure that makes mobile money actually work. We provide liquidity, cash-float distribution, and data-driven financing to mobile money agents, enabling them to operate continuously, serve more customers, and earn more per day. Through a combination of physical distribution points and software platforms; including float management, micro-loans, and predictive analytics, PayVista removes the capital and cash-availability constraints that limit agent productivity. PayVista turns undercapitalized mobile money agents into a high-performance, networked financial distribution system, expanding reliable access to digital financial services for underbanked populations.